MILO-blog for a MSCA-project

New paper on the enforcement of an emission tax

One of the project’s papers has been published. The paper contains a dynamic model on the consequences of imperfect enforcement of an emission tax applied to a polluting mine. Here’s the abstract:

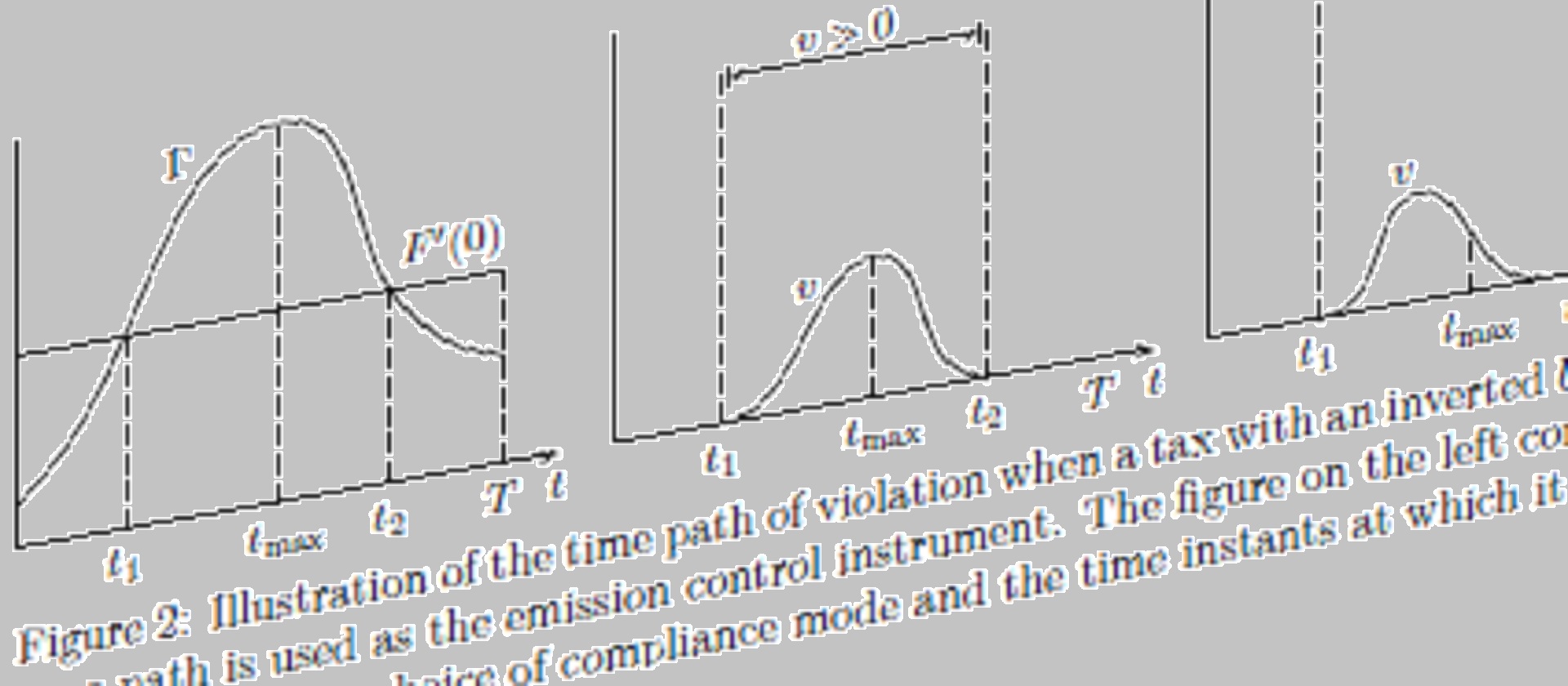

“The production of different exhaustible resources, and mining in particular, are a source of stock pollutants and the growth of these stocks can be constrained by abatement and taxation. However, the firm may have incentives to non-comply with these regulations. This study analyzes the enforcement of an emission tax in a dynamic model, which includes stock externalities and abatement by the mining firm and by natural processes. The purpose of this investigation is two-fold. First, to study the consequences of a given enforcement scheme in a dynamic model and to generalize the results from previous static models. Second, to analyze the time paths of control variables and the violation level. It is argued that non-compliance in itself does not necessarily imply that net emissions from the mine are excessive compared to the full-compliance emission level. It is the possibility of a zero emission report that may cause the divergence from the socially optimal emission levels. The time path of violation and hence the path of unpaid taxes can have multiple shapes depending on the type of tax applied.”

Suggested citation: Pauli Lappi (2019), “On the Non-compliance of a Polluting Mine under an Emission Tax”, Strategic Behavior and the Environment: Vol. 8: No. 1, pp 33-71. http://dx.doi.org/10.1561/102.00000090

Written on June 20th, 2019 by Pauli Lappi